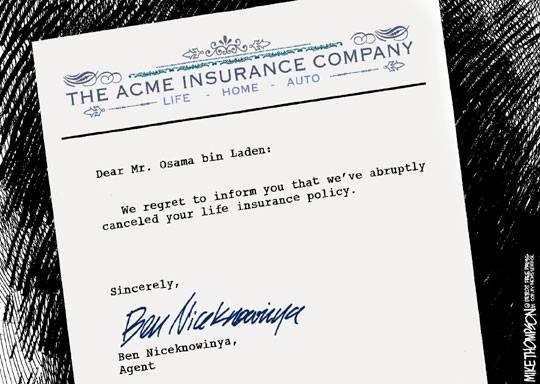

These excuses were on accident claim forms of a major insurance company. ere asked for a brief statement describing their particular accident.

1. The other car collided with mine without giving warning of its intention.

2. I thought my window was down but found it was up when I put my hand through it.

3. A pedestrian hit me and went under my car.

4. The guy was all over the place. I had to swerve a number of times before I hit him.

5. I pulled away from the side of the road, glanced at my mother-in-law and headed over the embankment.

6. The accident occured when I was attempting to bring my car out of a skid by steering it into the other vehicle.

7. I was driving my car out of the driveway in the usual manner, when it was struck by the other car in the same place it had been struck several times before.

8. I was on my way to the doctor's with rear-end trouble when my universal joint gave way, causing me to have an accident.

9. As I approached the intersection, a stop sign suddenly appeared in a place where no stop sign had ever appeared before. I was unable to stop in time to avoid the accident.

10. The telephone pole was approaching fast. I was attempting to swerve out of its path when it struck my front end.

11. To avoid hitting the bumper of the car in front, I struck the pedestrian.

12. My car was legally parked as it backed into the other vehicle.

13. An invisible car came out of nowhere, struck my vehicle and vanished.

14. When I saw I could not avoid a collision, I stepped on the gas and crashed into the other car.

15. The pedestrian had no idea which direction to go, so I ran him over.

16. I saw the slow-moving, sad-faced old gentleman as he bounced off the hood of my car.

17. Coming home, I drove into the wrong house and collided with a tree I don't have.

18. The indirect cause of this accident was a little guy in a small car with a big mouth.